Embrace Energy Efficiency with Solar Attic Fans – Transforming Home Environment

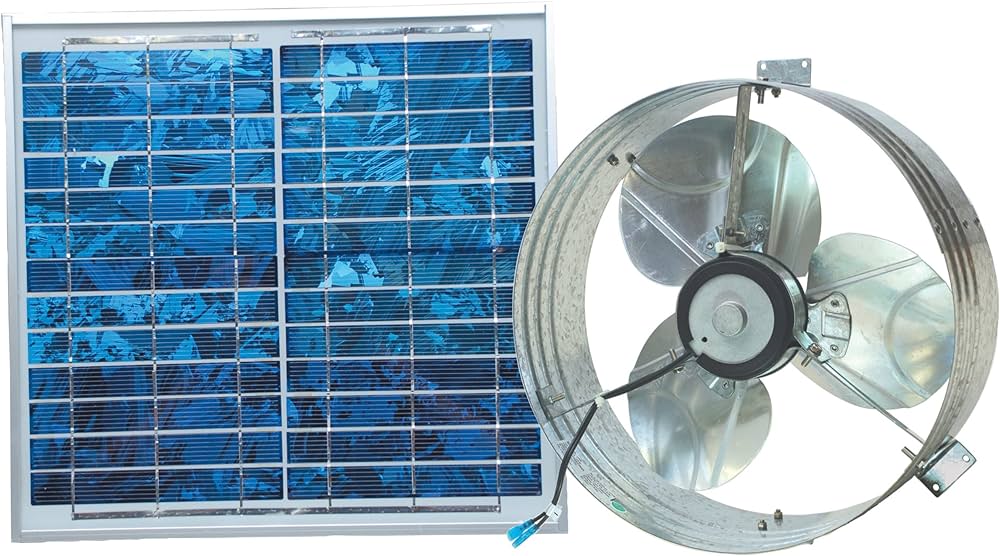

In the quest for a more sustainable and energy-efficient living, homeowners are increasingly turning to innovative solutions that not only provide comfort but also contribute to lower utility bills. One such transformative technology gaining popularity is the solar attic fan. Harnessing the power of the sun, these fans offer a dual benefit of enhancing home comfort and reducing energy consumption. At the heart of this energy-efficient marvel is a simple yet effective principle: solar-powered ventilation. The solar attic fan utilizes sunlight to generate power, which in turn drives a fan mechanism designed to expel hot air from the attic space. This ingenious system not only prevents the attic from turning into a heat trap during the scorching summer months but also alleviates the burden on air conditioning systems. By actively promoting air circulation, these fans contribute to maintaining a cooler indoor environment, making your home a more comfortable place to live.

What sets solar attic fans apart from traditional amazon solar attic fan ventilation systems is their cost-effectiveness. Unlike electrically powered fans that add to your monthly utility bills, solar attic fans operate entirely on renewable energy, thereby reducing your dependence on conventional power sources. The initial investment in installing these fans quickly pays off in the form of lower electricity bills, offering a sustainable solution for homeowners looking to trim down their energy expenses in the long run. Beyond the economic advantages, solar attic fans also play a crucial role in environmental conservation. By utilizing clean, renewable energy from the sun, these fans contribute to a reduction in carbon footprint, aligning with the global shift towards greener living. Homeowners embracing solar attic fans are not only making a smart financial decision but also participating in the larger movement towards sustainable and eco-friendly practices.

The installation process of solar attic fans is relatively straightforward, making them an accessible and practical choice for homeowners. They can be easily integrated into existing roof structures, requiring minimal modifications. With advancements in design and technology, these fans are not only efficient but also aesthetically pleasing, seamlessly blending into the architecture of your home. In conclusion, solar attic fans are a game-changer for those seeking enhanced comfort and reduced energy bills. Embracing energy efficiency through solar-powered ventilation not only transforms your home environment but also contributes to a more sustainable future. As we continue to explore innovative ways to reduce our carbon footprint, solar attic fans stand out as a practical and effective solution for homeowners looking to make a positive impact on both their wallets and the planet.